The Client is responsible for implementing the insights and techniques learned from the Coach.ģ.1 Overview. The Client acknowledges and agrees that coaching is a comprehensive process that may explore different areas of the Client's life, including work, finances, health, and relationships. The Coach agrees to maintain the ethics and standards of behavior established by the International Coaching Federation (ICF). Both the Client and Coach must uphold their obligations for the relationship to be successful. A coaching relationship is a partnership between two or more individuals or entities, like a teacher-student or coach-athlete relationship. The Coach will not be available by telephone, or email in between scheduled sessions. Payment after that date will incur a late fee of 1.0% per month on the outstanding amount.ġ.6 Support. The Client agrees to pay the amount owed within 15 days of receiving the invoice. The Coach will invoice the Client in accordance with the milestones in Section 1.3. Expenses do not need to be pre-approved by the Client.ġ.5 Invoices.

The Client will reimburse the Coach's expenses. Of this, the Client will pay the Coach $500.00 (USD) before work begins.ġ.4 Expenses.

The Client will pay the Coach an hourly rate of $150. The Coach and Client will meet by video conference, 4 days per month for 2 hours.ġ.3 Payment. This Contract can be ended by either Client or Coach at any time, pursuant to the terms of Section 4, Term and Termination. The Coach will begin work on Februand will continue until the work is completed.

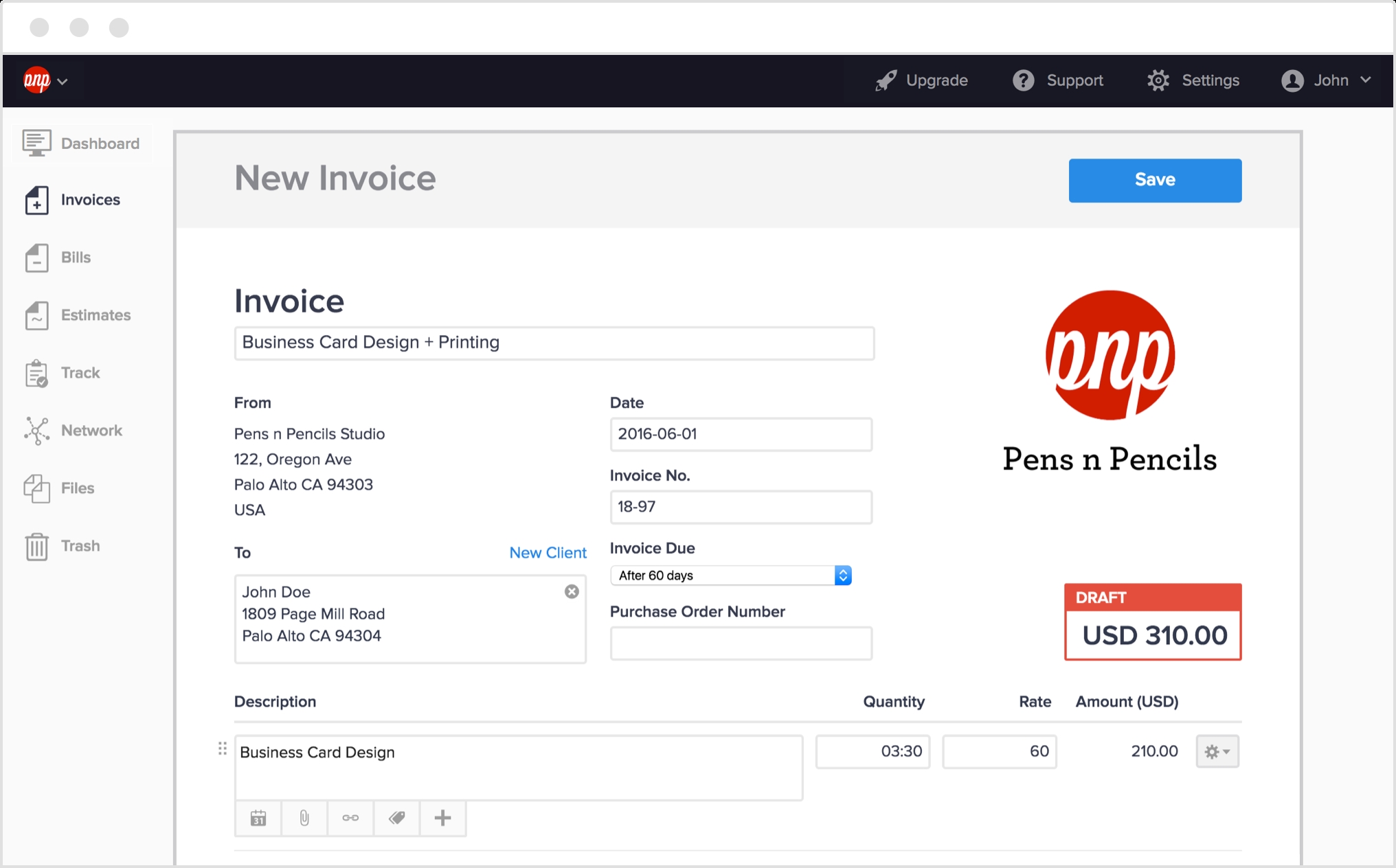

Simple online invoicing free professional#

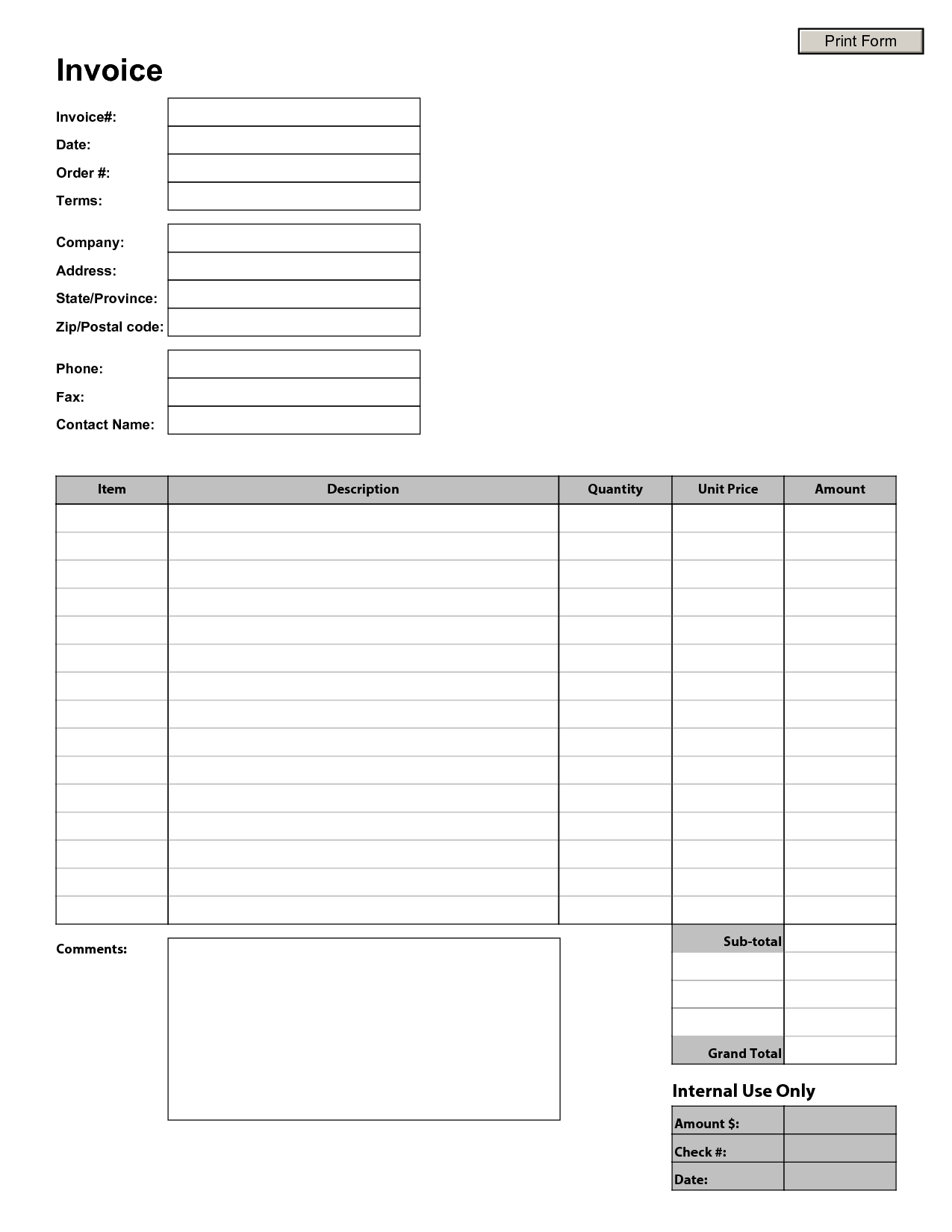

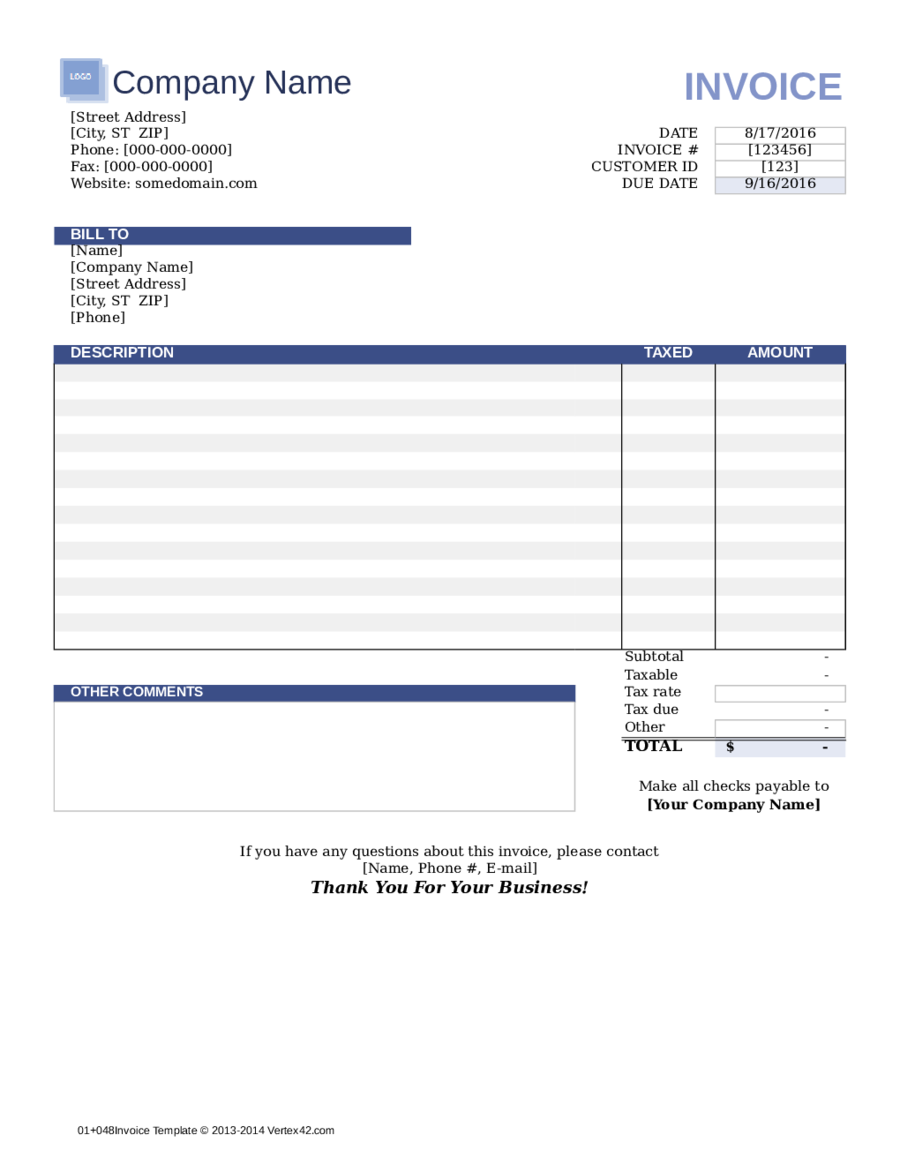

The Client is hiring the Coach to develop a coaching relationship between the Client and Coach in order to cultivate the Client's personal, professional, or business goals and create a plan to achieve those goals through stimulating and creative interactions with the ultimate result of maximizing the Client's personal or professional potential.ġ.2 Schedule. This is what your customer is required to pay you.This Contract is between Client (the "Client") and Acme LLC, a California limited liability company (the "Coach").ġ.1 Project. Total: The total displays the balance due which is calculated from the amount of each line item on the invoice.Notes: Within the notes section of the invoice, you can stipulate any additional terms of service that you've agreed to with your customer.So please consult your local tax resource to determine how much tax you should be applying to your invoices. This rate may differ depending on the geographic location you're business operates in. Tax: Indicating the tax rate applied to the cost of the goods or services provided is legally required on invoices.The line items also require a quantity so the customer knows how many goods or services they are being billed for, the price of the line item and tax rate applied to it, and the amount the line item costs. Line Item: Each line item on an invoice should have a name for the goods or services provided, along with a description of those goods and services.And, since invoices are often due in a specified number of days after receival, the invoice date is important in showcasing when payment is due. Invoice Date: The invoice date indicates when an invoice has been issued which helps your customers if they are receiving multiple invoices from you.Invoice numbers can be formatted in different ways such as file numbers, billing codes or date-based purchase order numbers. Invoice Number: Every invoice has a unique identifier in the form of an invoice number, which helps you keep track of multiple invoices.Bill to: Your customer's business name and address will be displayed within this section, as it indicates who is being invoiced for the receival of goods or services.Your Company Name & Address: The name and address of your company is usually displayed at the top of your invoice in order to differentiate between the company that is providing the goods and services and the company that is receiving them.Description: A description aides in helping your customer understand the nature of the goods and services being invoiced for.This is helpful for when tax time rolls around and for keeping accurate records of your invoices. Title: A title is a critical element of an invoice because it allows you, and your client, to differentiate between invoices.There are 10 elements of an invoice that you should be aware of, some of which are necessary while others can be used for customization.

0 kommentar(er)

0 kommentar(er)